France’s economic and political crisis is no longer a purely domestic matter: soaring public debt, an inability to reform, an ageing society, and chronic political instability now threaten the stability of the entire eurozone. The French welfare model functioned for decades, but it has now become unsustainable, and every meaningful reform attempt carries the risk of social explosion. Our insight examines how Europe’s second-largest economy arrived at this point, why it has become “too big to fail,” and what consequences all this may have for the future of the European project.

France’s public debt has reached a historic peak: for the first time, it has exceeded the country’s total annual economic output, now standing at more than €3 trillion (around 112% of GDP). This is hardly surprising given that France has run a budget deficit every single year for five decades – the last balanced budget was recorded in 1974. Decades of overspending have accumulated a substantial debt burden, while the deficit remains high (approximately 5.5% of GDP in 2023). Financing this debt is becoming increasingly expensive: interest payments on public debt already consume around €50 billion annually, a figure that could rise to as much as €80 billion within a few years. This money is already missing from other key areas, including education and healthcare.

Politics has so far proven incapable of bringing the process under control. Austerity measures or reform attempts have consistently run into social resistance, toppling governments one after another. In the past two years alone, five prime ministers have followed each other in office, a clear sign of chronic instability. Meanwhile, investor confidence is also beginning to crack: yields on French government bonds have been rising and at times have even exceeded those of Italian bonds.

Trapped by the Welfare Model

The roots of the crisis lie in the French welfare model. After the Second World War, France built one of the world’s most generous welfare states: free education, universal healthcare, unemployment benefits, and early retirement – the state took care of its citizens “from cradle to grave.” This became part of the national identity and, for decades, seemed sustainable: the economy was growing rapidly, the population was relatively young, and generous benefits were therefore easy to finance.

But this generosity came at a price. Even high taxes were insufficient to cover expenditures, so from the very beginning, the state filled the gap through borrowing. After the introduction of the euro, historically low interest rates made painful decisions even easier to postpone – governments preferred to keep stretching beyond their means rather than confront voters’ expectations. On the surface, the system appeared to work, but beneath the surface, tensions were steadily accumulating between the heavily spending welfare state and economic reality.

An Ageing Society and a Strained Pension System

The real breaking point came with the demographic shift. France’s population – like Europe’s as a whole – is ageing rapidly. Whereas a few decades ago five active workers supported one pensioner, today the ratio is barely three, and it will continue to deteriorate in the coming decades. People live longer, which means pensions and healthcare must be provided for longer periods. The foundation of the pay-as-you-go pension system – whereby current contributors finance current retirees – becomes unstable if the number of contributors declines sharply.

All of this places an unprecedented burden on public finances.

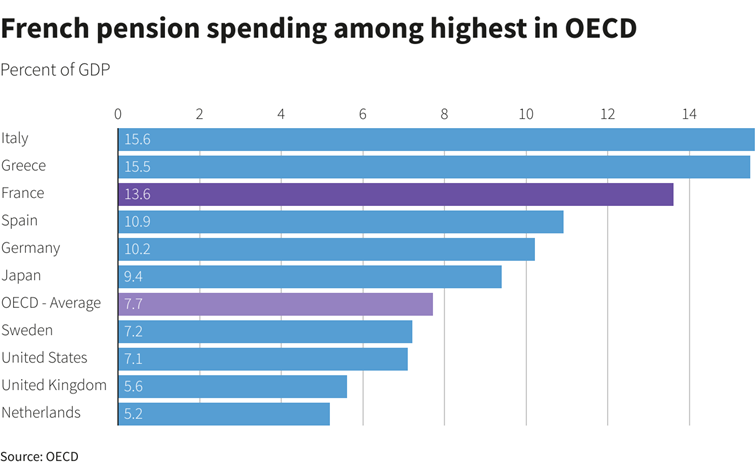

Pensions already account for a quarter of total French government spending, more than what is spent on education or national defence. Pension-related expenditures amount to nearly 14% of GDP – compared to an OECD average of barely 8%. Moreover, the relative income position of French pensioners is also unprecedented: their average income now exceeds that of the working-age population. In other words, the system ensures an exceptionally high standard of living for the elderly. At the same time, the burden is carried by a shrinking number of younger contributors – a situation that is unsustainable in the long run and a potential source of serious social tensions.

Reforms and Revolts

The problems would need to be addressed, yet in France, almost every reform attempt is met with revolt. In early 2023, President Macron tried to raise the retirement age from 62 to 64, but nationwide strikes and mass demonstrations paralysed the country. On some days, more than one million people took to the streets, while in Paris, rubbish piled up ankle-deep due to a sanitation strike. An overwhelming majority of public opinion opposed the reform. Macron ultimately forced the law through without a vote, using a special procedure (the infamous Article 49.3), which only further inflamed tensions. The government barely survived a no-confidence vote, while the president’s popularity sank to record lows. Although the increase in the retirement age was implemented on paper, it politically paralysed the cabinet.

This was far from the first time: previous pension and labour market reform attempts had also run aground under street pressure. This is how the state of reform paralysisemerged: everyone knows change is necessary, yet no one is capable of pushing through the decisions required to make it happen.

Too Big to Fail – A European Domino Effect

France’s troubles pose a danger to the entire eurozone. The French economy accounts for nearly one-fifth of the euro area’s output, meaning that a potential French sovereign default would shake the whole European financial system. France is too big to fail – and the markets know it. But if investor confidence were to collapse and the country’s solvency were called into question, it would knock over weaker eurozone states like dominoes. In such a situation, the EU would have little choice but to rescue France in some form, even if this meant violating its own rules and principles. The European Stability Mechanism would be insufficient for a bailout of this scale, and the European Central Bank would ultimately have to step in to provide unlimited liquidity. This, however, would set a dangerous precedent: if heavily indebted major powers know they can act without consequences, it could easily undermine confidence in the common currency. Eurozone decision-makers thus find themselves in a deadlock. A French financial collapse would mean a crisis for the euro, but an open-ended monetary bailout would also come at the cost of credibility. The coming years will determine whether France can be put back on its own feet – or whether Europe will be forced to swallow the bitter consequences of the fact that something has gone seriously wrong in France.

Rice, Roots, Rituals | A culinary and cultural journey through Chinese heritage in Budapest

Inner Radiance, Outer Freedom | Sonia Zander and the Power of Odesa’s Lightness